Supreme Lending Will Be Closed Monday, July 4, for Independence Day

In observance of Independence Day, Supreme’s offices will be closed Monday, July 4, 2022. The Fourth of July holiday isn’t considered a business day and cannot be included in the recession period for refinances or waiting periods.

As a federal holiday, banks will not be open for business on Monday; therefore, the Wire Desk will be unable to process wires and the Lock Desk will not issue a rate sheet. As a reminder, all locks must be valid through the disbursement date. Please be sure to request any necessary extensions to accommodate the rescission period as well as the lock expiration date.

Click here for the Bulletin with full details, including rescission dates and the closing disclosure calendar.

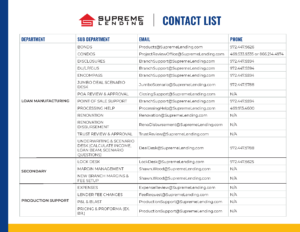

Easily Find Who to Contact for Help at the Corporate Office

The Corporate Department Contact List has been refined with more specific and the most up-to-date information so you can easily find who to contact for assistance. The comprehensive contact list is linked on the homepage of Supreme Insight.

The Corporate Department Contact List has been refined with more specific and the most up-to-date information so you can easily find who to contact for assistance. The comprehensive contact list is linked on the homepage of Supreme Insight.

With the document, simply find the topic you need support with on the left-hand side, then you will see the email address and phone number that correspond with the appropriate contact who can provide assistance.

Additionally, several department phone queues have been added for support versus calling individuals and possibly getting their voicemail. You can now call main department phone queue numbers on the list to get an answer every time!

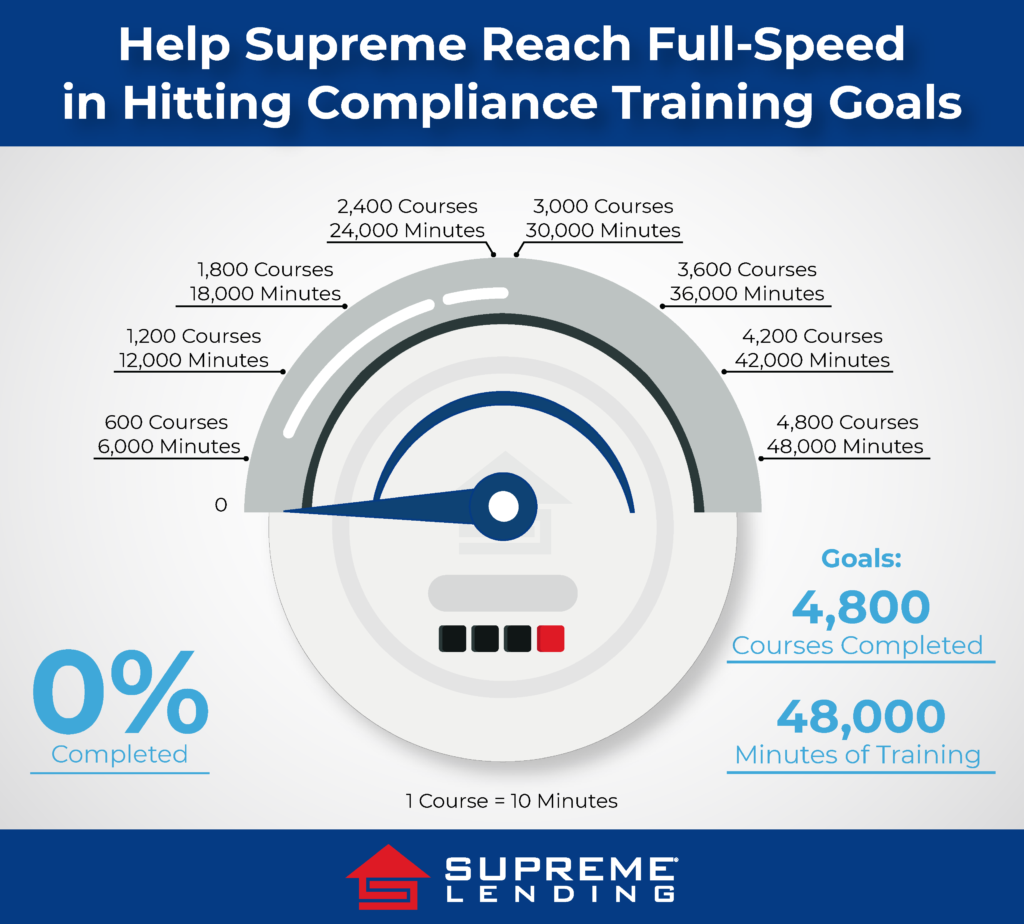

Compliance Training Will Launch This Week!

Can you believe we’re halfway through 2022? That means it’s time to start thinking about annual Compliance training, which is launching THIS week! In Docebo, you will soon be able to find the required Compliance eLearning courses on the Training Dashboard.

We’re excited to announce that for this year’s Compliance training, Supreme employees will only have to complete two courses that will take around just 10 minutes each. Both courses offer the ability to navigate directly to the assessment if you feel that you’ve mastered the content and are ready to take the short test.

The deadline for completion will be Friday, November 4, 2022. But why wait? With just 20 minutes or less of training, you can help Supreme go full speed to hit our Compliance training goals.

Learn Helpful Time Management Strategies

Two new eLearning courses are now available to help manage time more effectively and improve productivity:

- Adopting Timesaving Strategies: Get an overview of effective time-optimization strategies to help complete projects without burning out.

- Making a List and Checking It Twice: Learn several methods to keep track of daily, weekly, and monthly tasks and find out which resource may suit you best for staying task-oriented.

For questions or inquiries about Training, contact Training@SupremeLending.com or for Docebo-related issues, DoceboSupport@SupremeLending.com.

Reminder: Bond eFolder Placeholder Implementation Is Next Week!

We are in the final stages of the eFolder clean-up effort in Encompass with the organization of the Bond placeholders! We are moving to a generic naming convention for all Bond disclosures that are generated from the individual Bond Housing Finance Authority (HFA) portals. This process will streamline and reduce the number of placeholders in the dropdown list.

Please find an updated Bond eFolder Placeholder document linked below that specifies the changes. We appreciate the feedback we received and have incorporated the updates!

Here’s what each status change indicates:

- Eliminate/Relabel: The placeholder on the left will be eliminated. The placeholder on the right is an existing placeholder available today that is being renamed.

- Eliminate/Current: The placeholder on the left will be eliminated. The placeholder on the right is an existing placeholder available today.

- Eliminate/New: The placeholder on the left will be eliminated. The placeholder on the right is a new placeholder that will be available after the implementation date.

Beat the Heat and Stay Healthy This Summer

The July Hope Health newsletter is jam-packed with hot topics! Tips for sun safety and smart eating, ideas for keeping kids busy during summer break, and how to reduce out-of-pocket heath care costs are just a few of the insightful articles. Click here to check out this month’s issue.

Meet Bryan Williams, Jumbo Production Manager

Hometown: Cleveland, Ohio

Hometown: Cleveland, Ohio- History With Supreme: Been here for three years and am involved in Jumbo Underwriting/Scenario.

- Fact People May Not Know: Once was ran over by a jet ski in the middle of Lake Erie.

- How to Turn a Bad Day Into a Good One: Take a deep breath and think about all the positives in my life or go cut the grass at my house.

- Favorite Vacation Destination: Taking my RV and going camping.

- Special Interests and Hobbies: Enjoy all sports (watching and playing), fishing, camping, yard work, and hanging out with the kids.

- Favorite Holiday: Christmas. Who doesn’t love Santa Claus?

Hometown: Raised in Garland, Texas.

Hometown: Raised in Garland, Texas.

Hometown: Born in Del Rio, Texas. Raised in San Antonio, Texas.

Hometown: Born in Del Rio, Texas. Raised in San Antonio, Texas.