Supreme Day in January?

Martin Luther King, Jr. Holiday Notice

On Monday, January 17, Supreme Lending will not be observing Martin Luther King, Jr. (MLK) Day as a corporate holiday and will remain open. However, it is a federal holiday and banks will not be operating. It will not be considered a business day in the rescission period for refinances.

The Lock Desk will be open on MLK Day and will issue a rate sheet. Since banks will not be operating on MLK Day, the Wire Desk will be unable to process wires on this day and will resume normal functions on Tuesday, January 18.

See the Closing Bulletin for full details, including updated rescission dates and the Closing Disclosure Calendar, by clicking here.

Hybrid eClosing Pilot Update

We’re excited to announce that Supreme has partnered with Snapdocs to launch hybrid eClosing capabilities. This will provide our customers an enhanced digital closing experience and increase efficiencies. We’re launching a pilot on Friday, January 14, to test the technology and plan to roll out this solution companywide in phases throughout 2022.

How Does Snapdocs Work?

- Gives borrowers the ability to review and eSign closing documents in advance of their closing appointments.

- Sends and receives closing documents to and from settlement in a central location.

- Allows for a single place to communicate with the loan team, borrower, and settlement.

Be on the lookout for more information, training, and resources as we implement this new solution.

Supreme Connect Reminders: BBQ and Health & Wellness Virtual Meetups

If you’re interested in participating in these groups, sign up here.

Food & Drink:

The Basics of Barbecuing

When: Thursday, January 13,

4–4:30 p.m. Central Time (with manager’s approval)

Our first Supreme Connect virtual interest group kicks off tomorrow, Thursday, January 13, with Noah Zimmerman, Recruiting Manager and grilling enthusiast. See details above and a Zoom link to join.

Health & Wellness: Metabolic Rate and Caloric Intake

When: Tuesday, January 18,

4–4:30 p.m. Central Time (with manager’s approval)

On Tuesday, January 18, join the first Health & Wellness session led by Dan Howard, Manager of Business Analytics and Reporting. A fitness fanatic, Dan will cover the science behind resting metabolic rates and budgeting caloric inflows (what we eat) vs. outflows (what we burn). No matter your level of fitness or what your health goals may be, this 30-minute interactive session will provide great insights for the New Year.

FAQs About 1098 Mortgage Interest Statements

1098 Mortgage Interest Statements are tax documents used to report the amount of mortgage interest paid by the borrower and may help them take advantage of some home tax deductions. Here’s what to know about Supreme’s 2021 1098 Mortgage Interest Statements:

1098 Mortgage Interest Statements are tax documents used to report the amount of mortgage interest paid by the borrower and may help them take advantage of some home tax deductions. Here’s what to know about Supreme’s 2021 1098 Mortgage Interest Statements:

- All statements to borrowers will be mailed no later than Monday, January 31, 2022.

- To be eligible to receive a statement from Supreme Lending, borrowers must have paid $600 or more to Supreme in 2021 in any combination of interest, points, and mortgage insurance.

- Reportable points are only eligible for purchase primary residence transactions.

- Refinancing, second home, and investment property are not eligible.

- IRS reporting is limited to a single borrower’s name and social security number.

- If there are multiple borrowers on a loan, only the purchase primary borrower’s information will be reported.

- Multiple borrowers will need to properly allocate their contributions of the reported items they paid if filing individually. Supreme doesn’t issue a 1098 for each borrower.

Share Supreme’s Success in 2021

Available this week in Ignite is a ready-made, compliance-approved social media post to share Supreme’s total number of loans closed (53,686) and volume funded ($15,969,864,404). Use this post to thank customers, business partners, and vendors for their support.

Auto Pilot Program Can Now Post to Instagram on Your Behalf

How to Update Your Time Zone in Docebo

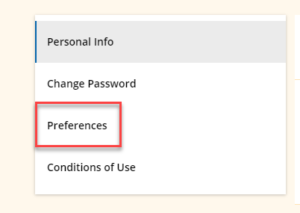

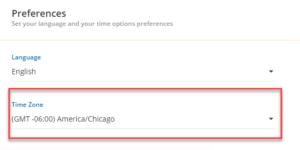

In Docebo, our digital training platform, you can now edit your local time zone if you’re not in Central Time. Doing so will seamlessly update all course schedules to your preferred time zone. Follow these quick and easy steps:

- Select the User Menu in the top left corner.

- Next to your email address, select the pencil icon to edit your Profile.

- Select Preferences on the lefthand side.

- Then, click the drop down menu under Time Zone to update it.

- Save Changes.

If you have any general training questions or need support, email Training@SupremeLending.com. For Docebo-related questions or feedback, email DoceboSupport@SupremeLending.com.

Meet Charla Black, National Production Services Processing Manager.

- Hometown: El Paso, TX

- History with Supreme: I worked at Supreme Lending’s branch in Huntsville, Alabama, for three years and joined the National Production Services team in 2014.

- What Charla likes most about Supreme: Teamship! Our team members are always ready to jump in and help.

- Charla’s process for turning a bad day into a good one: Remembering how much I enjoy the people I work with.

- Favorite TV show: Great British Baking Show

- Favorite book: Lonesome Dove by Larry McMurtry

- Fact most people don’t know about Charla: I’ve lived in El Paso, Texas; Heidelberg and Wurzburg, Germany; Hampton, Virginia; Atlanta, Georgia; and Huntsville, Alabama.