Go Pink for Breast Cancer Awareness on Social Media

The Marketing team has created several branded pink graphics for Loan Officers and team members to use on their social media pages available in Ignite.

- Facebook and LinkedIn Cover Images

- Pink Supreme House Logo Profile Image

- Social Media Post + Copy

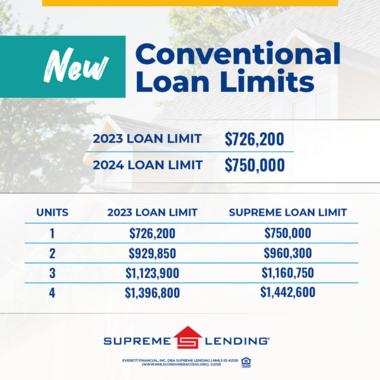

Promote Supreme Lending’s NEW 2024 Loan Limits

The Products team announced the new 2024 Loan Limits, which are effective now for Supreme Lending (even though they won’t be announced by Fannie Mae and Freddie Mac until the end of November). Supreme Lending is offering 2024 1-unit conforming loan amounts up to $750,000 for all states and counties.

Promote the exciting news with two branded flyer options and a Compliance-approved social media post now available in Ignite.

Welcome New CFO and VP of Finance & Analytics

This week on Supreme Lending’s Corporate social media pages, we announced welcoming our new Cheif Financial Officer, Ava Noack, and VP of Finance and Analytics, Chris Folse. View the posts on Facebook and LinkedIn to learn more about this amazing addition to our leadership team and give them a warm welcome!

In a challenging market, we are seeing patterns of fraud schemes. The presence of one or more red flags in a file does not necessarily mean that there is fraudulent intent. However, several red flags in a file may signal a fraudulent transaction and further due diligence is required.

It is important to know with whom you are doing business. Be diligent and make every attempt to be proactive. It is everyone’s responsibility to help prevent fraudulent activities, preserve our company’s culture and integrity. Most importantly, if the loan does not make sense, don’t do it!

CRITICAL:

Fannie Mae alerted the industry to potential and active mortgage fraud scenarios. This alert addresses loans originated in suburban Atlanta, GA but similar schemes have been reported in other parts of the country. Fannie Mae observed misrepresented borrower profiles in numerous loans that indicate theft and have allowed perpetrators to abscond with large sums of money at closing.

Hallmarks of the scheme include:

- Targeted attacks of identity theft

- Loan transactions are cash-out mortgages on homes without an existing mortgage.

- The borrower requests an appraisal waiver.

- Highly priced homes

- Loan amounts usually greater than $500,000

- LTV less than 50%

- All homeowner insurance policies are new.

- The majority of homes are in Cobb County/Northern Atlanta vicinity.

- The borrower specifics the title company to close the transaction.

- Borrowers use a common email structure: FirstName_LastName(numbers)@yahoo.com.

- Fabricated Federal Tax Returns are common in identified files.

October of Cyber Security Awareness Month

Every Thursday throughout the month, the Information Security team will be sharing tips and resources to educate how to be cyber smart. Here’s an overview of the upcoming topics:

- Social Engineering – Staying Alert for Subtle Scams

- Malicious URLs – Danger in Disguise

- Malicious Attachments – Don’t Open That File!

- Data-Entry Phishing Emails – Do Not Enter!

Additional tips and information can also be found on the Department of Homeland Security “Be Cyber Smart” awareness campaign. Remember: “Do Your Part. #BeCyberSmart” www.cisa.gov/be-cyber-smart

If you have any questions, please contact Information Security via Mark.Nagiel@SupremeLending.com. Thanks for participating in our effort to keep our company data safe.

Get Healthy Tips for Fall

The October Hope Health newsletter is packed with tips and insights to stay healthy this season. Topics include the ueses and benefits of physical therapy, how to stay hopeful and motivated, a cozy soup recipe, and more. Click below to check it out!

Congratulations to the McClellan Region!

Congratulations to Regional Manager John McClellan and his team in Austin, Texas. They have been recognized by the Austin Business Journal‘s Top Mortgage Companies list, ranking #9 in the area. Way to go team!