Tech Hub Updates: SimpleNexus Dashboard & Customer Facing Changes

Each month, our Tech Hub team will share the latest updates from our technology solutions that help improve efficiency and user experience, including upcoming releases and new features.

MySupreme (a.k.a. SimpleNexus)

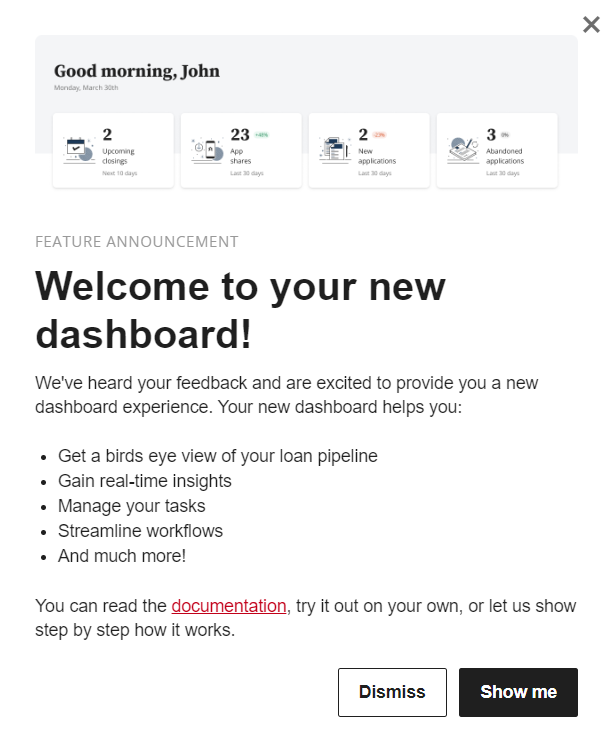

Exciting news for MySupreme users: Simple Nexus is launching a BETA release of a new dashboard for Loan Officers on Monday, August 14. Loan Officers will have an opportunity to take a tour of the new features or can ‘opt-out’ under their account settings. The change will take permanent effect on Wednesday, November 1. Here’s a preview of the message, including an overview of the new benefits.

Additionally, Simple Nexus is implementing customer-facing changes scheduled to be released Friday, August 18, which include:

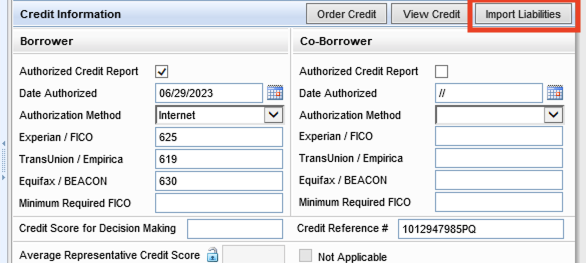

- Import Credit Liabilities for Auto-imported Loans***

- Update Disclosure Updates to Respect Disable Loan Update Settings

- Ignore NBOs without Email

- Add Setting to Make Loan Recalculation Optional When Updating Disclosure Tracking

- Warn Closers if Previous Recipients are Missing

- Auto-link Borrowers Added to Already Linked Loans

- TPO Connect Portal Issue

*** Most Applicable Change

SimpleNexus fixed a bug where imported credit reports from SimpleNexus were not able to import the liabilities. Any credit report received from SimpleNexus into Encompass will now be able to import liabilities.

Supreme Lending Is Launching Zoom for Phone Services and More

Supreme Lending will be rolling out Zoom companywide to replace our current Cisco/Jabber systems. Zoom is a cloud-based communications and collaboration service that combines chat, phone, meetings, whiteboard, and more into a single package. This will significantly simplify our phone/communications technology and increase efficiency, collaboration, and cost savings. All Supreme phone numbers will remain the SAME during the transition once it takes place. More details and training on Zoom will be coming soon.

What’s New in Training: New Product-Focused eLearning Courses

As the Training Team continues to launch new training opportunities to help team members learn and grow, they’ve partnered with Products to create new, enhanced training for specific loan programs.

Most recently, they launched a new eLearning course covering the Supreme Dream that outlines the program guidelines and how to set up first and second liens in Encompass. Click here to enroll in Docebo.

Other eLearning training includes AUS 101 to learn how to run and review the AUS (Automated Underwriting Services) Report to determine the overall risk of lending to a borrower. Click here to enroll in Docebo.

Go to Learning.SupremeLending.com to log in to Docebo via single sign-on and select to the Course Catalog.

For Training assistance or questions, contact Training@SupremeLending.com or for Docebo-related issues, DoceboSupport@SupremeLending.com.

Back to School Season Health and Wellness Tips

The August Hope Health newsletter is jam-packed with tips and insights for safe and healthy living—from protecting medical records to nutrition ideas to the benefits of decluttering and a productivity checkup. Follow the link below!

Scotsman Guide Named the 2023 Top Emerging Stars

Scotsman Guide, a leading national mortgage publication, recently announced the 2023 Top Emerging Stars, who honor the next generation of mortgage producers who are shaping the industry as more millennials and Gen Zers are entering the market and becoming homeowners. Congratulations to three Supreme Lending Loan Officers for being named honorees of this amazing award: Tony Nguyen, William Watson, and Chris Ruiz!

Check out the exciting announcement on our Corporate Facebook and LinkedIn pages.