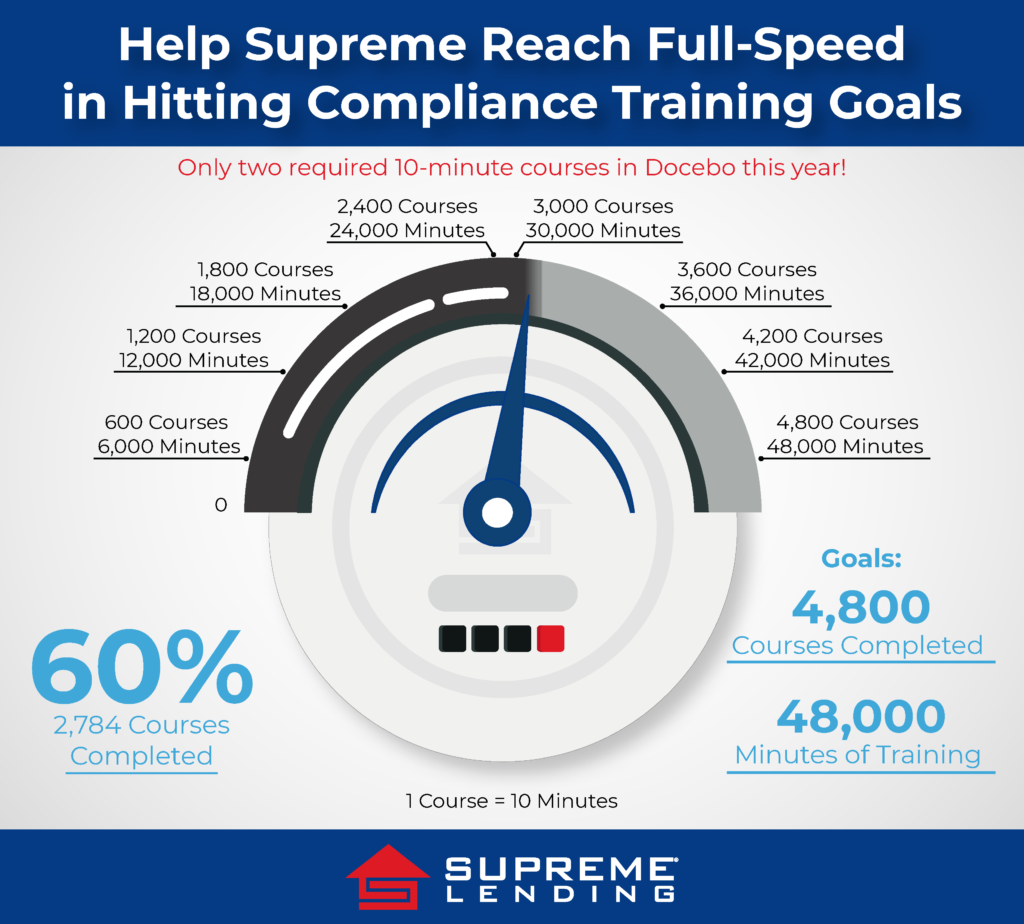

Final Countdown: Compliance Training Is Due in 10 Days

The Friday, November 4 deadline to complete this year’s required Compliance training is fast approaching! If you haven’t completed your training yet, please take 20 minutes or less to finish the two quick eLearning courses today. IMPORTANT: Failure to complete the training by the deadline will result in your access to Encompass being locked.

Congratulations to Reporting Manager Melanie Laywell for winning the most recent $50 drawing for completing the training! There will be one last drawing held on Friday, November 4.

Questions? Contact Training@SupremeLending.com or for Docebo-related issues, DoceboSupport@SupremeLending.com.

Share Photos for Supreme’s Commemorative Veterans Day Video

If you, a team member, or family member have served our country and would like to be included in Supreme’s tribute for Veterans Day, please send a photo to Concierge at Concierge@SupremeLending.com. With your submission, include full name, military branch, and rank.

Please submit photos by Friday, November 4, to be included in our commemorative Veterans Day video.

New Interest Rate Buydown Promotional Materials Now Available

The Marketing Team has created branded flyers and social media posts for Loan Officers to promote and educate about Supreme’s 2-1 and 3-2-1 Temporary Interest Rate Buydown programs.

Now available in Ignite, you’ll find:

- 2-1 Buydown Flyer – General

- 2-1 Buydown Flyer – Benefits for Homebuyers and Sellers

- 2-1 Buydown Flyers – 4 Loan Scenarios

- 2-1 Buydown Social Media Post

- 3-2-1 Buydown Flyer – General

- 3-2-1 Buydown Social Media Post

COMING SOON: Additional loan scenario flyers that outline payment examples for the 3-2-1 Buydown program are in progress.

Healthy Tips to Prepare for the Holiday Season

Stay healthy this holiday season with advice and insights from November’s Hope Health newsletter, which includes tips to boost brain health, develop mindful eating habits, navigate family relationships, overcome fear of missing out (FOMO), and more.

Reminder: Employee Surveys for Best Mortgage Companies to Work For

On Friday, October 21, the Best Companies Group sent surveys to a random sample of 350 Supreme team members—including Branch and Corporate employees—as part of the 2023 Best Mortgage Companies to Work For program by National Mortgage News.

We recognize that individually and as a company we have faced several challenges this year, not just at Supreme but the mortgage industry at large. While the timing of this survey may not be ideal, we are still taking this opportunity to participate in this contest as another means to gather employee feedback and identify areas of improvement.

If you received a survey, please take 10-15 minutes to complete it by Friday, November 4. Your honest feedback is extremely valuable to this process and will remain anonymous. Thank you in advance for participating in the Best Mortgage Companies to Work For survey.

This Week’s Tip: The Dangers of Password Sharing

One of the best ways to protect information is to ensure that only authorized people have access to it. Passwords are the most common means of authentication but only work if they are complex and confidential. Many systems and services have been successfully breached because of non-secure and inadequate passwords. Here are four reasons why you should never share your passwords:

- Compromises account security. Sharing passwords for any account results in the account being less secure. Giving your password to someone you trust does not mean there is nothing to worry about. They may store the password on a compromised device or an unsecure location.

- Reused passwords. Most people use the same password to access more than one account. Sharing a reused password significantly increases the threat.

- More privileges than needed. You may want to give someone access to your account so they can find specific data, but we must remember that they will also have access to everything else in the account, such as email or other logins.

- Incidents will be logged as you. Any actions that the person you have granted access to will be recorded as you. In situations where the cause of an information security incident requires an investigation, sharing of credentials can make the process of determining who is responsible difficult.

If you find yourself in a situation where others may know an account password, you should change it immediately.

If someone on your team is conducting work on your behalf and they need access to your account, it is possible that the wrong access rights were assigned. In these instances, please contact the IT Service Desk and open a ticket to have the employee’s access rights be reviewed.

If you have any questions regarding this policy, please contact Information Security via Mark.Nagiel@SupremeLending.com. Thanks for participating in our team’s efforts to keep our company data safe.

Meet Don White, Bond Purchase Clearing Specialist, and His Growing Family

This special Employee Spotlight shares Don White’s inspiring foster care adoption story. Don is a Bond Purchase Clearing Specialist and has been with Supreme since 2012.

This special Employee Spotlight shares Don White’s inspiring foster care adoption story. Don is a Bond Purchase Clearing Specialist and has been with Supreme since 2012.

Married for 14 years, Don and his wife Quita wanted to grow their family. After dealing with infertility treatments and learning the high costs of adoption agencies, they looked into foster-to-adopt programs. With so many children in the foster care system who need loving homes, Don and his wife became licensed foster parents and began their journey. In November 2019, they took in two young siblings who needed emergency placement. Two years later, they were excited to move forward with adopting them, but one of the kid’s relatives stepped in and took custody. Devastated the adoption fell through, Don and his wife then tried match-to-adopt programs.

At an adoption fair, they met a young foster child who they had inquired about earlier but never heard back. There was an instant connection! After a couple of weekend visits, their new foster daughter moved in during May 2022, and she will be officially adopted on November 19, which happens to be National Adoption Day!

At an adoption fair, they met a young foster child who they had inquired about earlier but never heard back. There was an instant connection! After a couple of weekend visits, their new foster daughter moved in during May 2022, and she will be officially adopted on November 19, which happens to be National Adoption Day!

Another exciting surprise also came to light for the Whites. They received a call that the two children who they had initially fostered needed a home, and they were asked if they would be willing to take them in again. Despite the challenges and the current market, they couldn’t say no. It was like they never left! Ages 4, 6, and 11, the Whites have a full house filled with playfulness, love, and joy! Don loves the opportunity to share their story and raise awareness about the foster care program.