Pipeline and Reporting Cleanup in Encompass Is Complete!

Have you noticed anything different in Encompass this week? Recent enhancements to pipelines and reporting are now in effect! These exciting changes are outlined below:

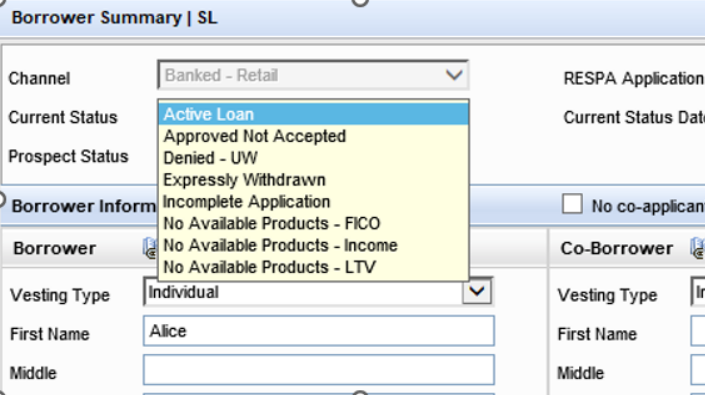

- Files are now automatically moved to the Adverse Action folder when the loan status is changed to anything other than “Active Loan.”

- Any loan with a credit app status that is not “Active Loan” is automatically moved to the Adverse Action folder. This enhancement impacts first and second liens in the Current Prospects, My Pipeline, and Underwriting folders.

- Non-active loans no longer appear in pipeline views and reports.

If you have questions or need assistance, please contact BranchSupport@SupremeLending.com.

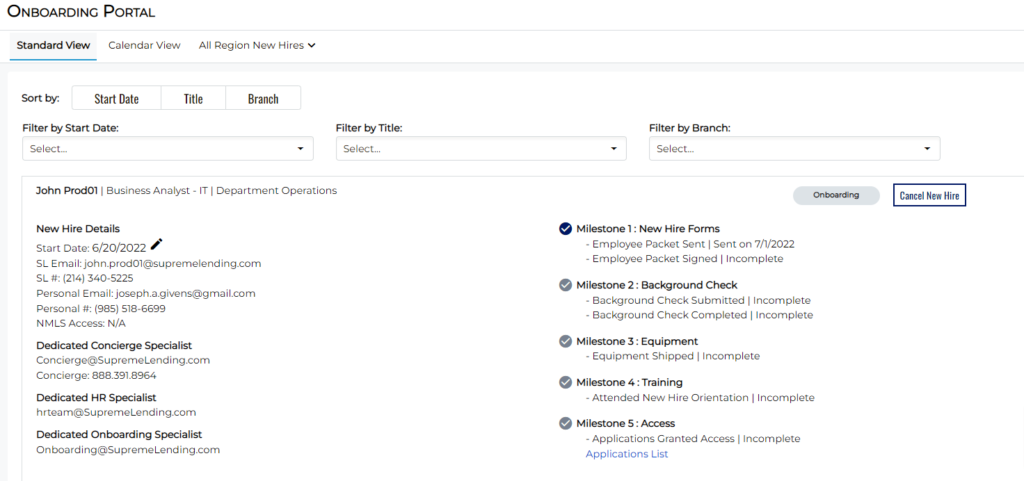

Reminder: Request New Hire Packets on the Recently Launched Onboarding Portal

Hiring Managers can now submit a new hire request and oversee the hiring of new team members on Supreme’s new online Onboarding Portal. This portal provides real-time status updates on where a new hire is in the onboarding process. With a fresh look and feel, hiring managers can easily enter and find New Hire Details and see which of five onboarding Milestones have been completed, as shown in the screenshot below:

How to Access the Onboarding Portal

You can access the portal at Onboarding.SupremeLending.com or by selecting the “Request a New Hire Packet” on the HR page of Supreme Insight. You must be logged in to the Supreme system or VPN to access the portal. New functionality will be added to the Onboarding Portal when available to further facilitate the hiring and onboarding process. Watch for more features to come!

Introducing Supreme’s New Loan Officer Servicing Portal

“Who is now servicing my loan?” If Loan Officers only had a nickel for every minute they’ve spent answering that question for customers! Now it will take no time at all to find the answer and other key loan information on Supreme Lending’s new Loan Officer Servicing Portal.

Feedback from pilot users say the portal is life-changing, as its self-serve options save Loan Officers so much time after closing. Simply plug in a loan number and find important loan data at your fingertips!

How to Access the Loan Officer Servicing Portal

You can access the Servicing Portal Report (4072) directly from MyReports via the Top Reports for Branches subfolder. A button linking to the portal is also available on the homepage of Supreme Insight.

Note: You must be logged in to the VPN to access the portal on MyReports.

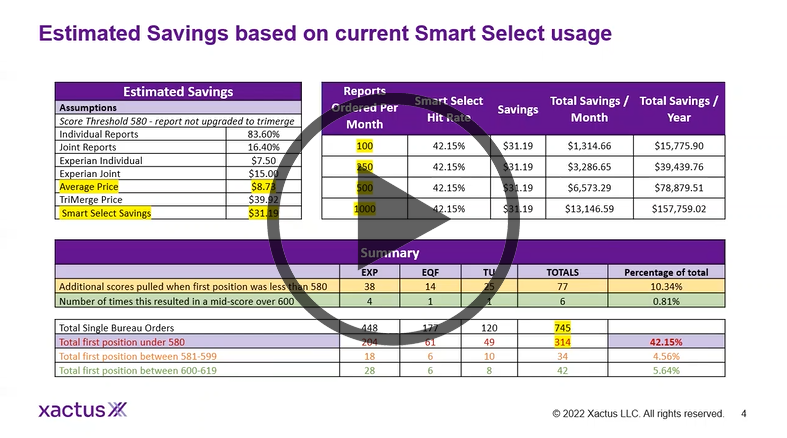

Save $1,000s on Credit Reporting with SmartSelect

Are you tired of spending money on pulling tri-merge credit reports only to find out the borrower is not loan ready? That’s where SmartSelect comes in. This cost-control tool helps determine who should have a tri-merge credit report pulled and, more importantly, who should not. Credit thresholds can be customized and set by Branch Managers. The best part—it’s free for all Supreme Lending Branches to sign-up and start using today.

How Will SmartSelect Benefit You, Your Branch, and Your Loan Officers?

- Reduces credit reporting costs (by an average of 16%)

- Increases efficiencies

- Mitigates risk

Watch this video for a brief overview of the platform and see realistic examples of how much Branches can save each month with SmartSelect.

To sign-up, contact Access Management at AccessManagement@SupremeLending.com or 972.447.5626.