Regularly Scheduled System Maintenance Will Be Held This Weekend

Supreme Lending IT will be conducting our regularly scheduled system maintenance beginning:

Friday, June 10, 2022, beginning at 9 p.m., through Saturday, June 11, 2022, at 6 a.m. Central Time.

Offer Customers an Enhanced Experience With Hybrid eClosing

Supreme has completed the companywide rollout of hybrid eClosing! Branches can now offer their customers the opportunity to opt-in to Supreme Hybrid eClose, if available for their loan program. If using hybrid eClosing, please ensure Branch Fee Sheets are updated for accurate disclosures.

Hybrid eClosing saves time and helps improve the quality of closing documents. The process allows customers to review closing documents, including those that will need notarization and to be signed in person, before the file is sent to the title company. Customers can then ask questions beforehand. Any needed or requested changes can be made prior to the closing appointment so there’s no waiting at the closing table for documents to be redrawn.

If you haven’t attended the hybrid eClosing training but would like to, please contact Training@SupremeLending.com.

For any questions about hybrid eClosing, please contact Anthony.Dotson@SupremeLending.com.

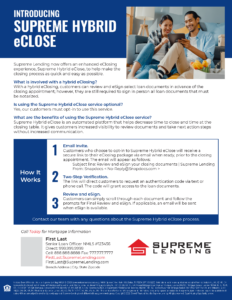

Promote Supreme Hybrid eClose With a New Branded Flyer

A new flyer is now available in Ignite to educate customers about Supreme’s hybrid eClosing service. The flyer clearly outlines what is involved in a hybrid eClosing, the benefits of the service, and the three easy steps of the process customers will need to take.

CLICK HERE to view, customize, and download the flyer in Ignite.

Download the Updated Condo Review Questionnaires

For Branches looking to obtain condo review approval, the Project Review Office (PRO) Team has updated the Limited and Full Review Questionnaires. These questionnaires include additional condo review addendum information combined into one document to streamline the process. The questionnaires have been updated in Supreme Insight on the Project Review Office page and in Policies and Procedures. Follow the direct links below to download the questionnaires.

CLICK HERE to download the new Full Condo Review Questionnaire.

CLICK HERE to download the new Limited Condo Review Questionnaire.

7 NEW eLearning Courses Now Available in Docebo

The Training Team is excited to announce the release of seven new on-demand eLearning courses covering a variety of topics for both professional and personal development. Follow the links to view more details and enroll in Docebo.

- Lock Desk

Get a 10-minute refresher on performing various Lock Desk processes. - Mortgage Fraud

Learn how to spot suspicious activity and combat mortgage fraud. - Managing Conflict With Others

Strengthen conflict management skills with a proven process to improve collaboration and efficiencies. - Delegating With Others

Get a roadmap to help determine what to delegate to others to be more effective. - Delegating With Clear Expectations

Get tips on establishing clear agreements regarding what will be done when delegating to others. - Getting Buy-In When Delegating

Learn a set of helpful, encouraging questions to discuss when assigning work. - Planning Your Day

Discover tips for planning daily priorities that will lead to long-term success.

As a reminder, all courses are available via Docebo on the Training Dashboard. For questions or inquiries about Training, contact Training@SupremeLending.com or for Docebo-related issues, DoceboSupport@SupremeLending.com.

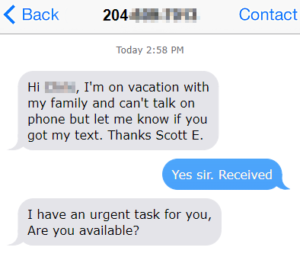

This Month’s Tip: SMS Phishing (Smishing) on the Rise!

A form of phishing, known as smishing, is the act of using text messages to trick individuals into disclosing sensitive information, visiting a dangerous website, or downloading a malicious app onto a smartphone. These innocent looking messages may ask to confirm banking details, verify account information, or subscribe to an email newsletter via a link delivered by SMS. As with phishing emails, the end goal is to trick people into an action that plays into the hands of cybercriminals.

Smishing attempts have risen dramatically, and Supreme employees are in the crosshair. Here is one example of several seen last month:

The good news is that the potential ramifications of these attacks are easy to protect against. In fact, you can keep yourself safe by doing nothing at all. The attack can only do damage if you take the bait.

Here are a few things to keep in mind that will help you protect yourself against smishing:

- Do not click on any link or call any number received from an unknown sender.

- A message from an unknown sender that urges for a quick reply is a clear sign of smishing.

- Never provide personal information such as usernames, banking information, or other account details through text.

- Remember that legitimate companies will not ask for personal information over text.

- Be on the lookout for messages that contain the number “5000” or any number that is not a phone number. These are often associated with email-to-text services that criminals can use to avoid providing an actual phone number.

- Understand that smishing is not limited to just texting – WhatsApp, Facebook, and other messaging services are all potentially vulnerable.

CLICK HERE for the PDF version of this month’s tip bulletin.

If you have any questions regarding this tip, please contact Information Security via Mark.Nagiel@SupremeLending.com. Thanks for participating in the Information Security effort!

Meet Your Supreme Lending Licensing Team!

The Supreme Licensing Team is responsible for managing all license activity for the Company, Branches, and Loan Originators. The team currently monitors:

- 350 Branch Locations

1,507 Total Branch Licenses - 1,310 Licensed Loan Originators

4,338 Total Loan Originator Licenses - 83 Total Company Licenses

Get to know each of the team members, their specialties, how they serve you, and contact information!

CLICK HERE to download the Meet the Team flyer featured below.